Our client, a well established accounting firms in Sydney, wanted to expand their business. As they acquired more clients, they started hiring more accountants and the management became busy with their business expansion.

Despite adding new clients, the firm had low client retention rates and low profitability. In effect, the firm became less profitable as their workforce became busier.

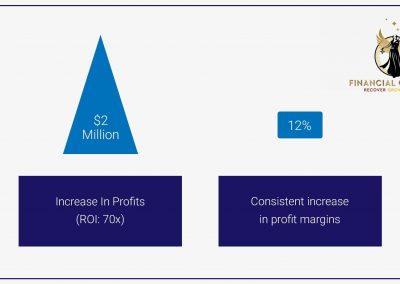

The accounting firm also wanted to raise more capital by taking on more business partners but they were unable to prove potential ROI (return on investment) on the business that would satisfy the capital they needed to raise. The client was now stuck in a catch 22 situation where they were not able to attract the type of business partners nor the desired investments to fund their growth ambitions.

- Implemented strategies for the client with respect to mergers, acquisitions, takeovers and restructures to optimise the return on investments (ROI) in those transactions.

- Implemented business processes that significantly improved the profit margins.

- stituted “best practices” for the client’s management team during peak demand cycles.

- The new set of implemented business processes improved the overall business profitability by nearly 37%.

- The ATO proportion of rulings in favour of clients increased from 35% to nearly 90%.

- Based on my strategic advice, the accounting firm was able to secure new partners as a strategic move to complement their existing service offerings instead of purely taking decisions based on capital.

- Due to improved profits, the firm was able to maintain higher ROI per partner and fund their expansion goals.